Preventing the Negative Externalities of Development: Shirking, Capacity, and Incomplete Contracts

Presented at the American Political Science Association (APSA) conference

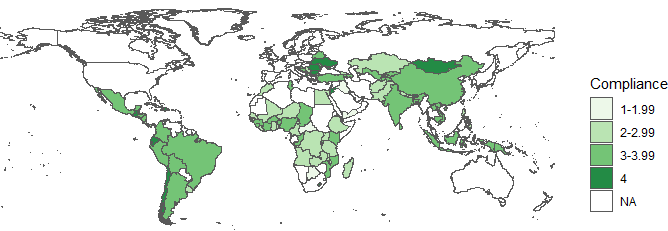

This paper examines the potential negative externalities of foreign aid projects: that is, costs that accrue to people outside the aid transaction between the recipient state and the aid organization overseeing projects (the agent). Both scholars and the media tend to blame agents for aid implementation problems. However, recipients are nowadays responsible for implementation, negative externalities can drastically affect people's livelihoods, and politicians generally want to credit-claim from aid and avoid blame for failures. Accordingly, I argue that both state capacity and agent quality explain the prevention of negative aid externalities. Given that powerful donor countries only have limited bandwidth to affect project implementation, I diverge from principal-agent accounts and also argue that donor influence is minimal. To the extent that donors have influence on aid implementation, it is via their effects on agents. To test the hypotheses, I compile new project-level datasets on World Bank Task Team Leader quality and recipients' compliance with safeguard policies on involuntary resettlement, indigenous peoples, and the environment. Statistical support for the hypotheses from numerous models and measures suggests that availability and representativeness biases color how scholars and the media approach aid failures. More broadly, future scholarship needs to move beyond its focus on principal-agent accounts and consider the role of incomplete contracts between agents and recipients. Otherwise, related literature will remain susceptible to a social engineering fallacy, as principal-agent accounts have difficulty distinguishing agent shirking from capacity constraints. [Draft Paper]